Do you know the benefits of investing in real estate? Have you ever thought about how the rich seem to make growing their wealth look easy? Do you think you will be able to retire comfortably when the time comes? Perhaps even more importantly, are you aware that you should invest but don’t know where to begin?

If you answered “yes” to any of the previous questions, there is a good chance that you have a lot more questions of your own. Today’s financial world is as equally intimidating as it is intriguing. However, with the right insight, investing can be one of the most lucrative endeavors you partake in. Real estate investing, in particular, has proven – time and time again – that it can serve as a wealth-building vehicle for savvy investors. Our partners at CT Homes have flipped hundreds of properties in every market condition, proving definitively that real estate is a viable investment strategy.

The following was created to help you understand some of the investment opportunities made available to you, and why we think investing in real estate is the superior option:

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

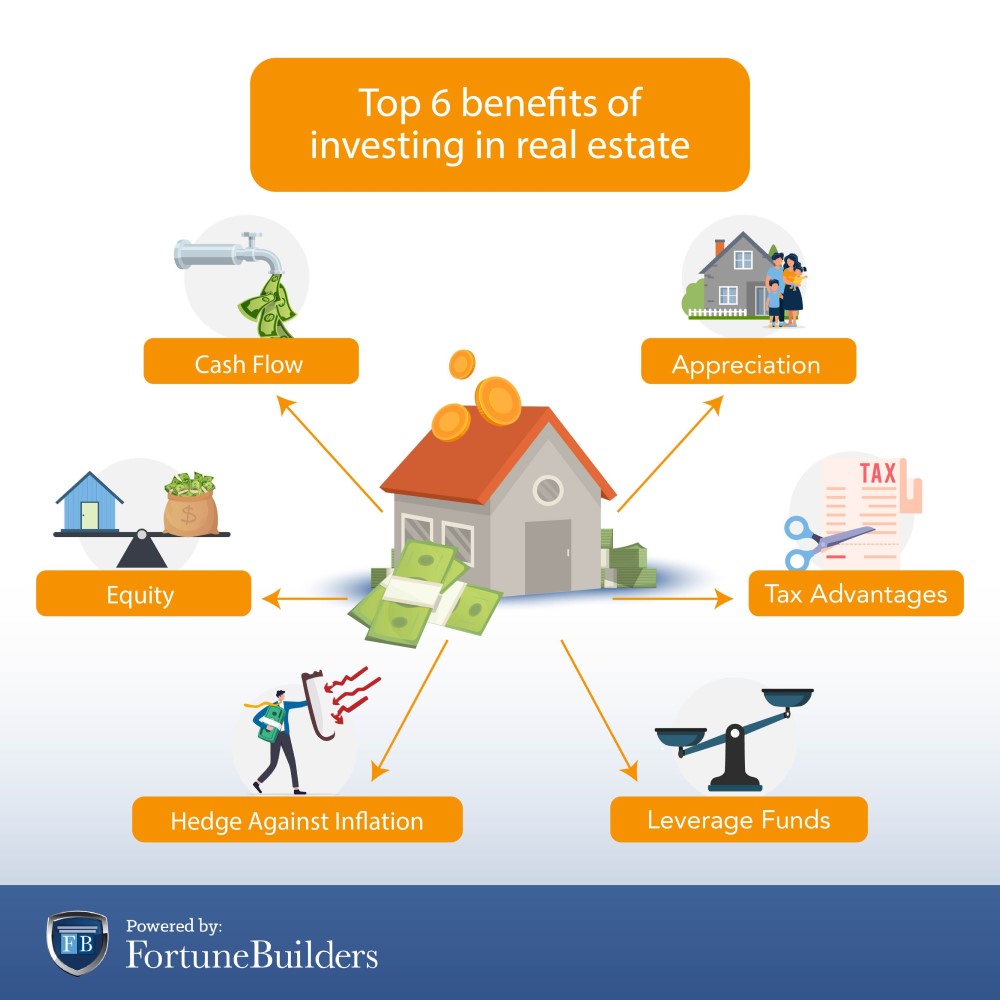

6 Undeniable Benefits Of Investing In Real Estate

Investing in real estate is a popular career choice for good reason. It takes dedication and strategy, but when properly executed, real estate investments provide a multitude of advantages over other career options. Read on to find out what benefits of real estate investing make it such an attractive profession.

1. Tax Advantages

Taxes are one of the biggest expenses for anyone – let alone a real estate investment company. However, there are ways to combat the loss of money in taxes with real estate. Rental houses, apartments, vacant land, commercial buildings, industrial, shopping centers, and warehouses all offer their own variation of tax incentives.

2. Cash Flow

Perhaps everyone’s favorite benefit, cash flow is essentially profit. Cash flow is what is left over after you collect the rent and pay your mortgage, taxes, insurance, and any repairs. Real estate is one of the best ways investors can generate cash flow. The monthly income that rental properties generate can offset investors’ expenses and put money back in their pockets. Over time the initial money the investment took is made back, and a positive return is seen. Cash flow is arguably the greatest benefit reaped from investing in real estate.

3. Hedge Against Inflation

Inflation is defined as a sustained increase in the general level of prices for goods and services. In other words, it causes every dollar you own to buy a smaller percentage of a good or service over time. Stocks, for instance, require more money to purchase with the increase in inflation. Essentially, inflation prevents your money from going as far as it would have. Real estate, on the other hand, serves as a hedge against inflation. Unlike almost every other form of investment, real estate reacts proportionately to inflation. As inflation increases, so too do rents and home values.

4. Leverage Funds

When purchasing a property, you have the ability to do so with leverage. It is entirely possible to purchase a $500,000 property with $100,000. You don’t even have to use your own money. Stocks, on the other hand, require 100 percent of the investment upfront. Leveraging money also allows you to initiate more than one real estate deal at a time because all of your funds aren’t tied up in one project.

5. Equity

If you borrow money to complete a real estate deal, you will be required to pay it back with interest. However, each payment also gets you one step closer to paying down your principal payments. You are simultaneously building equity and wealth in the same property.

6. Appreciation

Real estate is commonly thought of as a great investment opportunity because of its ability to increase in value over time. This process, called appreciation, makes it possible for real estate owners to buy and sell properties for a profit. Property appreciation is also an added benefit to owning rental properties. Not only will the home increase in value the longer you own it, but rental rates generally follow an upward trend as well. This makes real estate a profitable long-term investment.

Real Estate Vs Other Investments

Real estate investing is not the only way to invest. There are plenty of other investment options available, and each comes with its own set of strengths and weaknesses. Choosing the right way to invest is a personal decision that will vary based on the goals you hope to achieve and the level of work and dedication you prefer to commit to achieving a successful investment. One helpful way to get a better understanding of investment options available to you is to look at what makes real estate investing different by comparing it to other investments.

Real Estate Vs. Stock Market

The minute you decide to take the plunge and buy stocks, you will find yourself as the partial owner of a respective company – regardless of how small your share may be. As the company’s earnings improve, so will your stock. Savvy investors may be rewarded in the form of appreciation and dividends. In fact, since 1945, the average large stock has returned close to 10 percent a year. Stocks really can serve as a long-term savings vehicle. That said, stocks could just as easily depreciate. They are by no means a sure thing.

Not unlike real estate, playing the stock market has become synonymous with high returns for those that know what they are doing. However, it is just that: playing a game. The stock market is as much out of your control as anything can be. If you invest in stocks, you will be at the mercy of a relatively volatile market. That said, real estate is the polar opposite regarding certain aspects. Net earnings in real estate are reflective of your own actions. You are really in control of your own money. Any money gained or lost is a direct result of what you do.

Real Estate Vs. Bonds

Stocks and bonds, while often lumped together, are fundamentally different from one another. Unlike stocks, bonds are not representative of a stake in a company. As a result, the return on a bond is fixed and does not have the opportunity to appreciate. Bonds function as a loan that a company pays back over time with interest. This, of course, makes bonds less volatile than stocks. However, bonds are not liquid and do not offer the same returns as most other investments. While bonds are relatively safe, they do not offer impressive returns like other investment strategies.

Typically, the safer the bond, the lower the interest rate of return. However, invested in carefully, real estate can rival the safety of bonds with a much higher return. The real advantage real estate holds over bonds is the time frame for holding the investments and the rate of return during that time. Bonds pay a fixed rate of interest over the life of the investment, thus purchasing power with that interest drops with inflation over time. Rental property, on the other hand, can generate higher rents in periods of higher inflation.

Real Estate Vs. Gold

Most people invest in gold for its popularity. It is as simple as that. There will always be a demand for the precious metal, as “Fifty percent of the world’s population believes in gold,” according to Chris Hyzy, chief investment officer at U.S. Trust, the private wealth management arm of Bank of America in New York.

According to the World Gold Council, demand softened last year. However, demand pressure is expected to increase in the latter parts of 2015. As a result, gold prices should come back down to earth. This should attract inventors looking to capitalize on the ground level.

Recognized as a relatively safe commodity, gold has established itself as a vehicle to increase investment returns. However, some don’t even consider gold to be an investment at all, rather a hedge against inflation. The precious metal acts to protect wealth against the risk of loss in select asset classes.

Of course, as safe as gold may be considered, it still fails to remain as attractive as real estate. Here are a few reasons investors prefer real estate over gold:

-

Unlike real estate, there is no financing and, therefore, no room to leverage for growth.

-

Unlike real estate, gold proposes no tax advantages.

-

In contrast to real estate rental, there is no income potential.

-

If gold does go up in value, the gain is nominal rather than an actual increase in buying power.

Real Estate Vs. Certificates of Deposit (CDs)

Certificates of deposit, or CDs, operate a lot like savings accounts. Seeing as how they are backed, they are virtually risk-free. Of course, unlike savings accounts, CDs offer a specific, fixed-term and interest rate. This form of investment is intended to be held until it matures, typically from three months to five years. When the CD matures, you can collect the original investment, along with some interest. Certificates of deposit do not appreciate, and they’ve had a historical average return of 2.84 percent in the last eleven years. Real estate, on the other hand, can appreciate.

Real Estate Vs. Mutual Funds

As their names suggest, mutual funds consist of finances that have been pooled together. The money is then invested into various asset types: stocks, bonds, similar mutual funds, and commodities like gold or fine art. It is one of the easiest ways to diversify any portfolio.

A mutual fund’s performance is always measured in terms of total return, or the sum of the change in a fund’s net asset value (NAV), its dividends, and its capital gains distributions over a given period of time.

However, much like stocks, you have little control over the performance of your assets. Future investment performance is subject to many variables. In fact, placing money into a mutual fund is essentially handing one’s investment decisions over to a professional money manager. While you can pick and choose your investments, you have little say over how they perform.

Benefits Of Investing In Real Estate: The Top Three Ways To Invest

The three most common ways to invest in real estate are as follows:

-

Buy And Hold

-

Rehab

-

Wholesale

Buy & Hold

With the worst part of the recession behind us, markets have been subjected to historical appreciation rates in the last three years. Home prices have grown more than 28 percent over the course of just 36 months. Buying low doesn’t mean what it used to, and investors have recognized that the landscape is changing. The spreads that wholesalers and rehabbers have become accustomed to are starting to conjure up memories of 2006 when values were historically high.

Of course, there are still countless opportunities to be had in the world of flipping real estate, but a new exit strategy has emerged as king: rental properties. As the name suggests, rental properties are acquired to rent them out. Otherwise known as buy and hold properties, these homes feed off today’s appreciation rates and capitalize on the fact that homes are more expensive than they were just a few short years ago.

The concept of a buy and hold exit strategy is simple: Investors will look to increase their bottom line by renting the property out and collecting monthly cash flow or simply holding the property until it can be sold at a later date – for a profit, of course. In holding on to a property, investors accomplish two essential things: they are simultaneously paying down mortgage obligations and increasing equity. This, of course, is all happening on the tenant’s dime. With cities like San Diego and Miami demonstrating an increased propensity for price appreciation, the prospect of having a tenant pay down the mortgage is incredibly enticing.

Upfront profits on buy and hold properties are in no way reminiscent of a rehab or wholesale. However, long-term, passive wealth opportunities abound. A properly run rental property has much higher earnings potential than short-term flips. Don’t believe me? Just look at what some investors in New York have been doing.

Some are even calling Manhattan apartments the new gold. Wealthy investors have started to realize that condos in The City That Never Sleeps are a great place to store and grow wealth. Prices have risen faster for a Manhattan apartment than for either gold or stocks. According to Larry Fink, who built BlackRock Inc., “The two greatest stores of wealth internationally today is contemporary art….. and I don’t mean that as a joke, I mean that as a serious asset class. And two, the other store of wealth today is apartments in Manhattan.”

There is no doubt that holding onto a property comes at a higher cost than storing gold, but properties – occupied or rented – come with significant tax deductions. Just one more reason that buy and hold properties are becoming so popular in today’s market.

Rehab

Historical appreciation rates have simultaneously driven up housing prices and suppressed investor spreads. There is no denying the lack of investor activity resulting from home price appreciation either. According to RealtyTrac, flips accounted for four percent of home sales in the first quarter of this year. For those of you keeping track, that is 17,309 flips, the lowest amount since the middle of 2011. However, that does not mean that there are no profits to be made on a rehab project. In fact, investors are making more than ever.

Just over a year ago, real estate investors made about $61,684 per flip. However, things changed quickly over the course of the year. The average gross profit for a flip during the first quarter of 2015 jumped to $72,450.

“The strong returns for home flippers in the first quarter demonstrates that there is still a need in this recovering real estate market for move-in ready homes rehabbed to more modern tastes, particularly given the dearth of new homes being built,” said Daren Blomquist, vice president at RealtyTrac.

There is no denying that rehabbing is still a prominent factor in today’s real estate landscape. It is just a matter of minding due diligence and capitalizing on opportunities that present themselves. A lot can be said for developing a system. In fact, our partners at CT Homes have their own system when rehabbing a property:

-

Stage #1 (Scope of Work Development):

-

Stage #2 (Job Bidding and Contractor Selection):

-

Stage #3 (Contract Communication at Signing):

-

Stage #4 (Six Critical Documents):

-

Stage #5 (Managing the Rehab Process:

-

Stage #6 (The Property Closeout):

-

Stage #7 (Preparing to Sell):

Wholesale

Real estate investing can accommodate a variety of exit strategies and even more unique approaches, but none may be more conducive to the “green” investor than wholesaling. This particular strategy comes with less risk and upfront costs than previously discussed methods. However, profit margins on wholesales are not as large as other strategies.

The foundation of a wholesale deal revolves around the idea of an investor serving as the middleman between a seller and an end-buyer. That said, it is the investor’s job to gain the rights to a respective property and sell their contract to the buyer. There are two methods in which an investor can wholesale: They can either sell or “assign” their purchase contract to an end buyer, or they actually close on the property and immediately resell the property to another investor in the form of a “double close.”

A typical wholesale deal does not require the investor to own the property. The goal is to own the right to buy the property – a binding contract, if you will. With the contract in hand, the wholesaler then sells their rights to the property for an “assignment fee.”

Summary

Real estate investments have the power to unlock endless opportunities for those who commit to the business. The passive income that each investment generates allows successful investors to control their time and choose to live the lifestyle they desire. Take time to review the real estate investing strategies available to decide which opportunity is best for you to make the best-educated decision. Remember one thing: the benefits of investing in real estate are as impressive as your potential allows them to be.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

The information presented is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing provided shall constitute financial, tax, legal, or accounting advice or individually tailored investment advice. This information is for educational purposes only.